Should I Invest In Cardano Dapps

Cardano Dapps Should I Invest In Them? We all know that Cardano is a big project, currently sitting at around 44 billion market cap. Cardano at the time of writing is ranked #6 by market capitalization and it is common knowledge that it will be harder for Cardano to triple or quadruple in value thus the urge among the crypto community to find the next 10x, 20x, 30x low marketcap cryptocurrency, so the question that comes up is Should I Invest In Cardano Dapps instead?

There is a lot of demand for promising crypto projects that are expected to 5x, 10x or even 100x.

This can be seen easily through crypto YouTube influencers which their main purpose is to shill a coin.

But how likely are them to achieve such returns?

In this article we are going to focus more on projects that belong to the Cardano ecosystem.

Looking back in history

The best way to avoid making mistakes or to know what your next step should be is to look back in time. Should I Invest In Cardano Projects instead? Would I be better off investing in a single cryptocurrency? What can Ethereum Dapps and Solana Dapps tell us?

Ethereum Dapps

Back in 2017-2018 the first Ethereum Dapps went live, many of them reaching a solid and high valuation.

Googling Ethereum Dapps and specifically seeking posts from that lapse of time, we come across many websites listing the Top Dapps by the time.

Performance of The Primary 10 Ethereum Projects

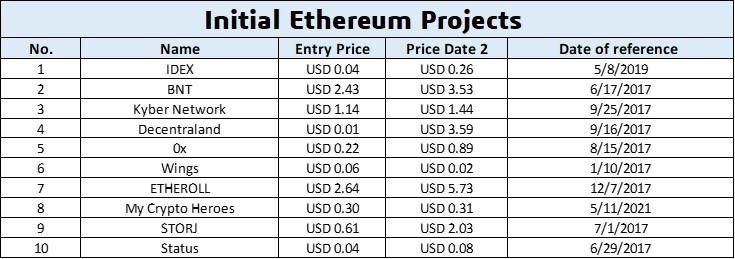

We picked 10 Ethereum Projects from trustworthy sources cited below and a few other websites at the top on the Google search results.

- IDEX

- Bancor (BNT)

- Kyber Network

- Decentraland

- 0x

- Wings

- Etheroll

- My Crypto Heroes

- STORJ

- Status

Most of the time when a token is recently launched, there is a lot of demand to get the token, this case is very common in overly hyped tokens, for this matter it is convenient to DCA, and not just to jump in with highly unrealistic prices. The entry price in the table is the price which results of evenly distributing the capital over the course of two months.

The “Price Date 2” in the table refers to the current price at the time of writing (12/23/2021).

We retrieved the price data from many trusted sources such as: Coingecko, CoinMarketCap, Coinbase.

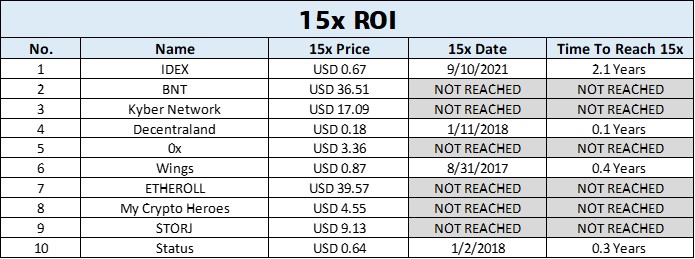

Result of Investing In Primary Ethereum Projects

Imagine we were searching for projects to invest in 2018, and we came across many websites suggesting us to invest in 10 projects as those listed above. If we were to invest an evenly amount of money in those projects, how likely are we to 5x, 10x or even 15x? how long would it take us to reach there? Is it better to “Hodl” or to sell?

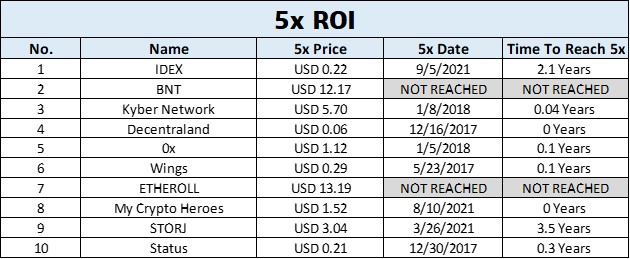

5x Return

In the table above we have:

5x Price: The price the cryptocurrency needs to reach to get us a 500% ROI.

5x Date: The date on which we reach the 5x price target.

Time To Reach 5x: The amount of time needed in years to make a 5x in our investment.

We used the “Not reached” phrase when projects didn’t reach a 500% return of investment.

We made the same for 10x and 15x returns. Our goal is to make the most out of our money as fast as possible.

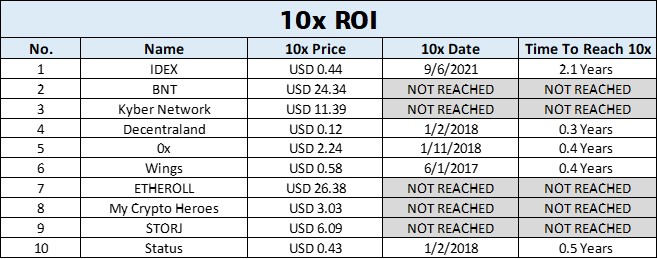

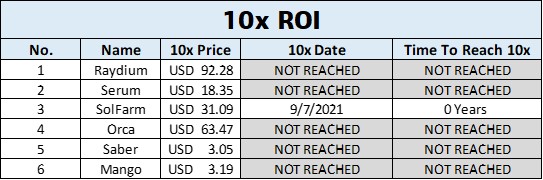

10x Return

15x Return

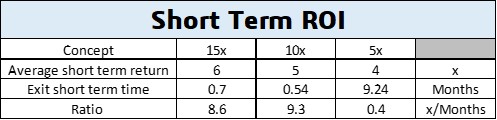

After comparing these 3 tables, we can sort out what price factor give us the best results.

As you can see, seeking for a 10x give us the best return in the shortest amount of time (Highest ratio, 9.3).

Many of the project didn’t reach the 10x return and for the sake of simplicity, we assumed they had a 0x return. On average seeking for a 10x on those ETH projects you’ll get a 5x return.

The exit short term time in this case is half a month. This means that on average after the first purchase of the tokens, to get a real 5x return you’ll need to hold for 3.5 months. The DCA period after the token is launched is 2 months and we gave it another 1 month for analysis purpose.

Looking for a 15x: give us a 6x return on average in 0.7 months. 3.7 months after the first token was purchased.

Looking for a 10x: give us a 5x return on average in 0.5 months. 3.5 months after the first token was purchased.

Looking for a 5x: give us a 4x return on average in 9 months. 1 year after the first token was purchased.

Long term ROI

Long Term ROI Summary

As you can see the average return of the first 3 years following the launched date of the project is less the 200% ROI. The actual ROI as of the time of writing is 3190%, this discrepancy is the consequence of a very highly profitable project “Decentraland” that had an ROI of 29800% as of the time of writing.

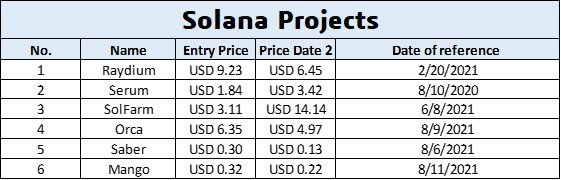

Solana Dapps

Solana is a burgeoning cryptocurrency with a proof of history consensus mechanism, as of the time of writing in just one year, it has gained a lot of traction with a 218x return.

Solana’s decentralized apps are fairly new and it may be a better reference point when trying to compare it to the upcoming decentralized applications in the Cardano ecosystem.

We picked 6 Solana Projects from many trustworthy websites such as: Dappradar.

- Raydium

- Serum

- SolFarm

- Orca

- Saber

- Mango

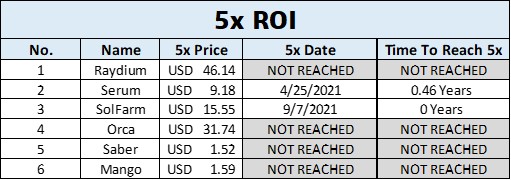

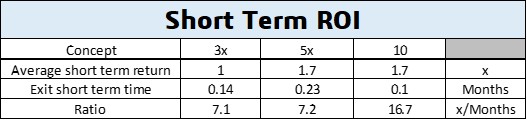

We decided to seek the best return, comparing the results while looking to make a 300%, 500%, 1000% ROI.

As you can see most of the projects didn’t even reach a 300% investment whereas most of the Ethereum Dapps reached the 500% ROI threshold within 3 to 4 months.

The “Short Term ROI” table shows us that the best return we obtained when looking for a 3x, 5x and 10x return was 1.7x in 1 to 2 months on average.

Solana & Ethereum Performance

Ethereum Price Growth (1/01/2017- 01/05/2019)

Solana Price Growth (08/01/2020 – 12/01/2019)

As you can see, at the time of the analysis we can see an exponential growth in the blockchain in which the Dapps are being deployed, this is a reflection as well of the demand for certain Dapps in the blockchain. For instance, if Ethereum is skyrocketing in price, is very likely that their Dapps may boom as well.

In the case of Cardano, we don’t know for sure if after more and more Dapps start to deploy, the price of the token itself will “moon” or tank.

We can only speculate, we can say that if they launch successfully, there will be momentum and hype around it, but that’s just that, a speculation.

Nonetheless, if the fundamentals are right, we should see more use and utility and thus the Cardano native assets start to appreciate later in the future.

Should I Invest In Cardano Dapps

This is the question we should ask. What decision should we take? Should we go all in on Cardano Dapps? Should we seek a short-term return or is it better to “Hodl” for many years?

Cardano has many interesting projects currently being develop.Charles Hoskinson in many YouTube and Twitter streaming has said that at the moment there are about 130 Dapps or more in the pipeline.

There are many interesting, decentralized apps coming out soon, we made a list of the projects with the best engagement and that right now are in the spotlight.

Cardano Most Engaging Dapps

- SundaeSwap

- Meld

- Liqwid

- Maladex

- World Mobile Token

- Ardana

- Genius Yield

SundaeSwap: is an Automated Market Maker (AMM) decentralized exchange inspired by the popular Ethereum based DEX Uniswap, with many interesting adaptations made for the Cardano blockchain.

Meld: is a lending and borrowing protocol in which the main purpose of the protocol is to unlock the most value of our crypto in fiat while keeping the potential growth in crypto without triggering a tax event.

Liqwid: is somewhat like Meld, open-source project from where users can securely earn interest in the assets they deposit. Is an improved Cardano version of Aave.

Maladex: is a revolutionary, research-driven, most innovative Cardano decentralized exchange. Maladex approach is to become most efficient DEX made my experts.

World Mobile Token: Is a Cardano based blockchain solution to the critical global situation in which half of the world population lack affordable and reliable access to the internet.

Ardana: Is an all in one, DeFi hub built in the Cardano ecosystem. This protocol has two main components: a decentralized stablecoin platform and an AMM stablecoin exchange (Danaswap).

Genius Yield: Is an AI powered decentralized exchange which aims to provide capital efficiency and a smart liquidity management which generally tends to be complex and time consuming.

What Should I Do

If we were to invest evenly in those projects and forecasting the same result of the primary Ethereum projects, the best return we would make short term would be a 5x in 3 to 4 months. Long-term projection gives us a 3,000% ROI in 4 years or more.

If we were to have the same luck as Solana DeFi projects than a likely outcome would be 1.7 in three months.

We don’t know for sure what can happen in a few months, and this is crypto everything from huge gains to big drop in prices can happen in a snap of finger unexpectedly.

Cardano wont likely have the same craze as Ethereum in 2017, so the 2017 outcome is not something we should expect. One thing we should have in mind is the long-term result from those hyped projects in 2017 were disheartening.

Most of them had a disappointing long-term upshot, the only outlier was Decentraland which had an outstanding growth.

We expect Cardano to have the same short-term outlook of Solana, a positive ascending trend not as burgeoning as in 2017.The long-term perspective in the future depends solely on the quality of the project and the capabilities of the underlying protocol in this case, Cardano.

Picking at least 5 Dapps with a promising long-term potential looks the most convenient choice to make, considering the risk of each individual projects that are outside of the scope of the well doing of the Cardano blockchain.