The Ultimate DeFi Guide

DeFi is a fast-growing financial instrument very notorious in the crypto space. DeFi is said to be the future and in this Ultimate DeFi Guide you will know a set of the most useful DeFi strategies and the risk associated with them. Is it worth it? What am I missing out?

DeFi is still a relatively new concept that was invented in 2018 by developers in the Ethereum Ecosystem. This innovative invention aims to change how the traditional financial system works.

The concept of DeFi can be described as the process in which a lender facilitate money to a borrower without any intermediary. The interest earned by the borrower can be referred as the APY (Annual Percentage Yield).

How Can We Make Money With Decentralized Finance (DeFi)

There are many strategies which can be used to earn money through DeFi.

The three most common ways to gain rewards on our capital using this new financial instrument are:

Staking: is when you use your coins to secure the blockchain network in a proof of stake consensus mechanism. You delegate a certain amount to a stake pool and for doing so you’ll be rewarded with staking rewards. It is the same as earning interest in a bank when you deposit a certain amount of money.

Liquidity Mining: is the process in which a user provides one pair of tokens in which each of them have the same monetary value into a liquidity pool, those tokens will be used to provide liquidity to an exchange by being available for other users to swap one another. Liquidity providers earn money whenever a user transact in the exchange because each transaction generates a fee.

Yield Farming: is the act of staking or lending your funds to earn rewards usually in the form of another cryptocurrency.

DeFi Platforms To Invest

When we are diving into DeFi ecosystems we need to look for projects with a lot of capital already flowing into, for this reason one metric that is widely used is the total locked value or TVL.

Blockchain with the highest TVL:

- Ethereum

- Terra

- BSC

- Avalanche

- Solana

Popular projects among popular blockchains

Ethereum:

- Aave

- Compound Finance

- Uniswap

Binance Smart Chain:

- Pancakeswap

Polkadot:

- Moonbeam

Terra:

- Terra Station

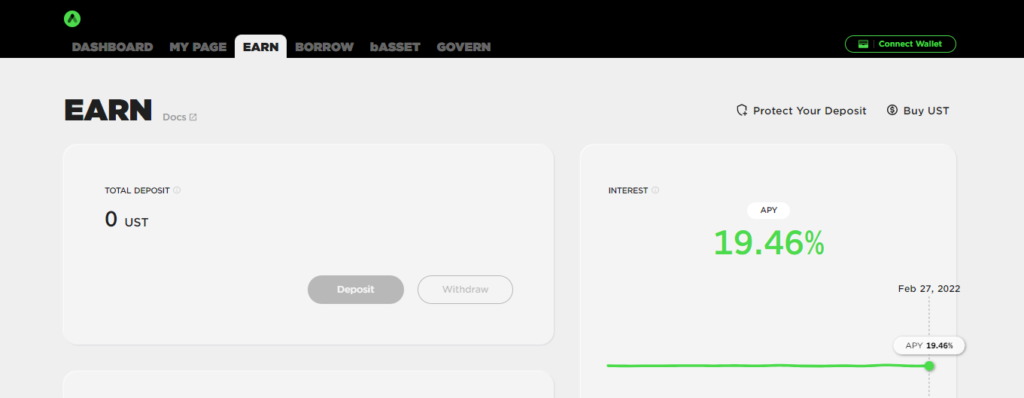

- Anchor. Up to 19.5% APY

- Astroport

We didn’t mentioned our beloved Cardano Blockchain, because it’s insertion in the DeFi space is fairly new with many upcoming interesting projects such as Meld, SundaeSwap, Genius Yield and many others, gaining traction. You might also find interesting: Should I Invest in Cardano Dapps

DeFi Strategies

Now that you know many of the different ways in which we can earn yield with our crypto, the next thing that comes to mind is, how can we optimize our earnings the best way possible, what kind of master plan should we use to leverage our earnings.

When it comes to finding a strategy in the crypto world, we need to think about Blockchains, Risk/Reward ratio, and portfolios.

A good strategy should include a secure blockchain with a good amount of trading activity and a diversified portfolio.

Strategies in the Terra and Binance Smart Chain Blockchains

Terra

If we had 1000 USD to invest in DeFi platforms of the Terra Blockchain, how would we do it?

Using Dynamo’s Approach:

We’re basically trying to find a solid Risk/Reward ratio:

DeFi Sample Portfolio:

- Stable Coin: 30%

- High Conviction, Large Cap: 40%

- High Conviction, Small Cap: 20%

- Moonshot/ “Degen”: 10%

Stable Coin

Stable coin: Using the Anchor Protocol: https://www.anchorprotocol.com/

Dexes: Terraswap, Astroport, Loop, Spectrum

They don’t display their APY. To view their APY we’ll use an external service: Coinhall.org

Anchor

Where Can I invest Stable coins in Terra? One of the most popular and well- known platforms is Anchor as of the time of writing gives us an average ROI of 19.5% annually. This ROI hasn’t changed in a long period of time.

Terra

Providing liquidity in Terra as of the time of writing in pools such as: aUST-UST gives us an APR of 22.6%

Risks of stablecoins:

This is the category with the less risk associated, and because they’re essentially stablecoins, you should not worry by the price if we go to bear market or a bull market, because the token valuation will be stable. Nonetheless bridge and attacks to the protocol are the risk associated to it.

DeFi Strategy – Providing Liquidity In Terra

High Conviction, Large Cap

If you are bullish on Luna, you may to have a little of exposure to it and given that there is the concern of Impermanent loss in providing liquidity, a safe option for this is to provide liquidity to the bLUNA- LUNA pool. Two almost equivalent assets.

bLUNA is the token you receive for bonding LUNA.

At the time, it had a 23.43% APR (this APR is taken as a reference, it changes over time).

If impermanent loss is not much of a thing to you, you may want to try providing liquidity to a pool like LUNA- USD with an APR of 80.67%

High Conviction, Small Cap

Osmosis is the main decentralized exchange in the COSMO blockchain.

Liquidity pools at the time:

- Luna/Osmo: 92.3% APY

- Luna/Atom: 28.46 APY

- Luna Market Cap: $25,197,058,219 USD

- Osmo Market Cap: $89,350,168 USD.

- Atom Market Cap: $9,809,814,238 USD

Luna: 238 Osmo MC

Luna: 2.6 Atom MC

- Luna/Osmo: 92.3% APY – Riskier pool.

- Luna/Atom: 28.46 APY – Most Conservative Choice.

Moonshots/” Degen”

ANC- USD pool: 99.75%

Anchor market capitalization: $287,386,406 USD.

Luna: 88 Anchor MC

Binance Smart Chain:

Pancakeswap – General Overview

There are three main ways in which we can make money in Pancakeswap. Some of them are:

- Staking

- Liquidity Provider

- Yield Farming

Staking: is less risky than providing liquidity but the ROI is considerably less as well.

It all depends on how much risk you are willing to take, if you are unfamiliar with DeFi it is convenient that you begin staking first and then go to more hazardous approach.

Liquidity Mining and Yield Farming In Pancakeswap

Like in the Terra Blockchain in the Binance Smart Chain you have a large variety of pools to choose from, some of the most pools are the following:

- Cake/BNB

- BUSD/BNB

Metrics, Performance in Pancakeswap

When we provide liquidity in pancakeswap with are given LP tokens that represents our share in the pool, with yield farming we can stake those LP tokens and earn rewards in the cake token.

Many metrics are displayed in the pools available in a way for the average user to get a brief overview of the pool actual and future performance such as: APR, Liquidity, Multiplier.

APR: is the annual percentage rate is different from the APR because after the rewards are given it’s opt to you if you want to reinvest the earnings. The APY is always higher than the APR.

Liquidity or TVL: is total amount of fund the pool has.

Multiplier: Refers to the amount of cake tokens allocated to each farm.

The Multiplier – Pancakeswap

The multiplier is a factor of the calculated APR. The biggest the Multiplier the biggest the APR. The multiplier is a way of determining how many cake tokens you’ll be rewarded when participating in a pool.

For instance:

Consider this:

You are providing liquidity to:

Cake/BNB pool:

- Liquidity: 200,000,000 USD

- APR: 100%

- Multiplier: 2x

BUSD/BNB

- Liquidity: 200,000,000 USD

- APR: 100%

- Multiplier: 1x

If the liquidity of both pools doubles the APR in the Cake/BNB will be halve to 50% and the liquidity of the BUSD/BNB will be reduced to 25%.

If you are providing liquidity in the Cake/BNB pool and let’s say that the liquidity at the moment is 200,000,000 USD with a Multiplier of 2x and an APR of 100%, and in the BUSD/BNB with the same liquidity and APR but with a 1x multiplier.

The multiplier protects you when there is an increase in liquidity.

Risk Associated with Providing Liquidity and Yield Farming:

When we’re providing liquidity there are some risks associated to it, it is not a free lunch. Many of these risks depends on the underlying blockchain, the Dapp in which the smart contracts are running and many other factors:

Risk associated to Liquidity Mining:

-Impermanent Loss (LP): When you are providing liquidity in a pool, and one of the assets of the pairs increases or decreases in value relative to the other.

It’s called impermanent loss because the loss is not realized unless you withdraw liquidity of the pool, you could just wait until the prices of both tokens comes up to their original ratio the IL would be smaller.

–Smart contracts: There is the risk of a bug in a smart contract that can be exploited by attackers.

Here are some examples:

- Smart Contract Bug Results in $31 Million Loss

- Hackers Exploited a Logical Flaw to Steal $80 Million From DeFi Platform Qubit Finance

- Cross-chain protocol Multichain bug gets exploited for $1.34 million

-Project Risk: We should know the background of the project, who are the founders? Is the project audited? How long has the project been running?

Here’s an example:

Chef Nomi, the founder of Sushiswap, removed liquidity, a six-figure amount from the ETH/SUSHI pool. This caused the price of sushi to plunge resulting in investors losing a huge amount of money.

Conclusion

DeFi is the future of finance and will be evolving in its way up, it’s important to keep up with any new concept, strategy that we may see, as better and more efficient ways to earn yield with DeFi will come to play.