How Much ADA Do You Need To Retire?

How much ADA do you need to retire? Have you ever wondered how much money you would need to retire and live a wonderful and happy life? What about crypto?, Altcoins?, ADA? Here you will find that out!

Are you tired of working? Hate your boss? would you like to spend your time on things that really matter to you, which you cannot turn into a profession? Would you like to spend more time with your family? Have you ever imagined a life where you can travel around the world without having to count your vacation days? For this and more reasons people join the FIRE movement.

Don’t like reading? Here’s our YouTube video!

Investing In Crypto

If you are not living under a rock, then you must have heard of it. Bitcoin, Ethereum, and The Ethereum killer A.K.A Cardano are many cryptocurrencies at the top. We are going to focus though on one of our favorites: Cardano. Cardano is a very promising cryptocurrency with a solid foundation widely known for its peer-to-peer review methodology.

It is not a bad idea to hold your bag of ADA and, if you have already done so, you may be asking how much of these “Cardano coins” you will need to hold and stake in order to have a decent amount of ADA in a couple of years. Furthermore, how much ADA do I need to retire? why ADA? is ADA a good Investment? you may also want to check out: IS IT WORTH INVESTING IN CARDANO.

The amount of ADA you will have in a couple of years will depend on numerous factors such as:

- Staking APY

- The Principal Sum

- Time span

- Active investing / Passive investing

Staking APY: This depends on the pool you decide to stake. The Annual Percentage Yield (APY) will depend on several technical factors such as the saturation limit, distribution rates, total block per epoch, and the stake ratio.

A rule of thumb is: that smaller, unsaturated pools have a better return for stakeholders than larger saturated pools.

The Principal Sum: The principal sum or the money invested into this crypto.

Time span: If we stake for a longer period of time, we will get more tokens.

Active/passive investing: Whether you are constantly throwing money into this asset, making your bag of ADA bigger or you are planning on making it a one-time purchase and stake it for as long as you want to.

Diversification

We have heard many times “don’t put all your eggs in one basket”, the logic behind this is quite simple, if something happens to your basket, you will be left with no eggs.

Portfolio diversification is just that, if you put all your money into one particular asset eventually, if that asset crashes, you will be at risk of losing all your money.

The cryptocurrency market is now in its beginnings. In this regard, there is no doubt that its market capitalization will grow in the long term. Even though we have seen periods of short-term stagnation, the value of many digital assets is expected to increase through the years.

3 Reasons To Diversify

- Cryptocurrencies are volatile. Diversification is a good shield that will cover you from unexpected negative market swings.

- You get a piece of the cake of many well-performing cryptocurrencies.

- It lets you discover many interesting altcoins that otherwise would not be noticed by you.

Altcoins Move With Bitcoin

Bitcoin is down, Ethereum is down, Dogecoin is down, is it possible to diversify in crypto?

We know that to some extent most altcoins are tied to bitcoin, but there are still ways of diversification because there are a lot of distinct types of cryptocurrencies.

There are many ways of diversification. Cryptocurrencies can be divided into:

- Industry: Finance, artificial Intelligence, medicine, energy, etc.…

- Type of cryptocurrency: Stable coins, transactional tokens, smart contracts tokens.

- Time (dollar-cost averaging): Investing constantly despite the ups and downs of the market.

How Much ADA Do I Need?

Diversification is good, but you may be a great believer of Cardano and think that no one or nothing can ever bring it down long-term, and you might throw all your money into it, this is why we prepared a throughout explanation of how likely you are to retire with x amount of ADA, staking without withdrawal for a y amount of time.

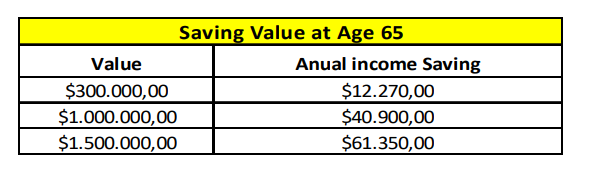

This annual income saving has a life expectancy of 91 years if withdrawn at a spending rate of 4.09%.

Source: Chief Investment Office, Portfolio Analytics, “Beyond the 4% rule: Determining sustainable retiree spending rates,” January 2020.

How long will it last you? It does not only depend on how you save and invest but also on the spending rate, and how you will spend your money once you retire.

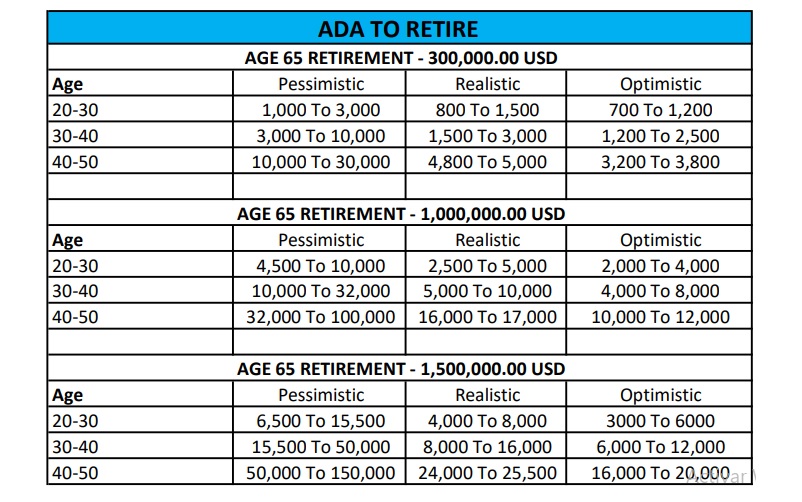

How much ADA do I need?

In the table above, you are given the number of ADA you need to stake in your wallet, for a y amount of time. You have three main targets depending on your income goals or your spending rate at your retirement age.

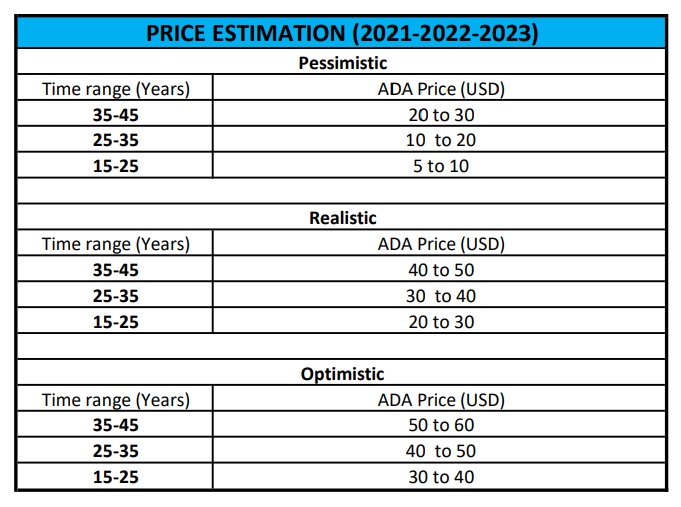

These prices are accurate until the year 2023, after that the ADA price in the table above is expected to increase.

Price estimation

The table above have three main categories: pessimistic, realistic, and optimistic. To the left, we have the time range in years.

If we want to have a realistic approach of the market value of 1 ADA, to put it another way, we want to know what the price of 1 ADA will be in 15 years. We can look at the table and see that 15 years from now (Year 2021), Cardano will reach 20 USD.

Want to use our Cardano Retirement Calculator Instead?

Example

For example, if you are a 30-year-old that would like to have a 12,270 USD retirement income, adjusted for future inflation (300,000 USD saved), considering that Cardano turns out as expected, assuming it will not have a stunting mass adoption or a sizable growth, that being the case, you would need around 1,500 ADA to retire at the age of 65.

Retiring at 65 with just 1,500 ADA being a 30-year-old, how is that possible?

If you have 1,500 ADA and stake all of it, without any withdrawal at a 5% APY, then at the age of 65, you will have around 8,300 ADA. If we assume the price of 1 ADA to be around 40 USD (in today’s dollar), then our ADA will be worth 332,000 USD (8,300 x 40), reaching our goal of 300,000 USD.

Conclusion

As you can see, it is very rewarding to have some ADA staking for many years. Investing the right amount of ADA for the right amount of time, with an average pool ROI is enough to retire, assuming that Cardano performs well.

Assumptions

- The price of the token and the retirement threshold are not adjusted for future inflation, they are in today’s dollars (2021).

- The projected prices of ADA are measured from the year 2021. Therefore the amount of ADA required to retire would be increasing over time. (The estimation is accurate until 2023).

- Taxes are not considered, so the amount of ADA required to retire is higher than the amount we used.

- The ROI from ADA staking is 5% annually.

- A realistic assumption for the price of 1 ADA in 2030 is 15 USD, as suggested by InvestAnswer.