How frugal living is the best way to become wealthy

We are going to explain to you how frugal living is the best way to become wealthy. We have to tackle down the mayor problem here that we tent to spend significantly more money than we should and it is important to know that this is a huge mistake.

Why it might seem hard living frugally? The short-term happiness that comes from buying a new phone or a new car disappears in a short time and that is why you have to learn to combat the impulse to buy.

If you would like a more visual presentation of this subject, feel free to check our youtube video.

What is living frugally

- Frugal living is spending in a smart way

- Frugal living isn’t being stingy

- Frugal living is spending on valuable things

We know that living cost money. No matter how hard you try to save, it is impossible to go day by day without spending money on something we tempt to buy.

We can track our expenses and try to cut them:

Expenses:

- Entertainment

- Education

- Shopping

- Personal Care

- Kids

- Transportation

- Housing

- Food

You can use an app to track your expenditures and incomes or if you are pretty good with Excel and technology and you are such a technophile you can make your own Excel spreadsheet, both ideas can work well.

However, there are minimal expenses on which it would be difficult to cut them out without drastically reducing the quality of life, from the list I can tell many of them (Medication, food, Kids).

So how frugal living is the best way to become wealthy

Let’s break down this topic into pieces so you can know how frugal living is the best way to become wealthy

Let’s take a look closely:

| Expenses |

| Entertainment |

| Education |

| Shopping |

| Personal Care |

| Kids |

| Transportation |

| Housing |

| Food |

| Expenditures |

| Income |

| Investment |

| Business profit |

| Returned Purchase |

| Bonus |

| Salary |

| Capital gains |

By reducing expenses and increasing revenue you’ll have more money to invest.

One of the main ingredients to take into consideration is the compound interest as Andrew Hallam says in his book: Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School, Compound Interest—The World’s Most Powerful Financial Concept, and it’s truly powerful.

About this book:

The incredible story of how a schoolteacher built a million-dollar portfolio, and how you can too Most people wouldn’t expect a schoolteacher to amass a million-dollar investment account.

Click on this link or image to buy this book

(I may earn a small commission at no cost for you for my endorsement, recommendation, testimonial, and/or link to any products or services from this website.)

Compound Interest-The World’s Most Powerful Financial Concept

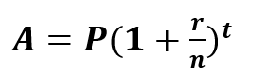

What is compound interest? Compound interest is the result of reinvesting interest rather than taking it out as of simple interest, so that you’ll have invested in the next period the first principal sum plus the accumulated interest.

A= New principal Sum

P=Original Principal Sum

r =Nominal annual interst rate

t = Time in which the interest is applied (usually expressed in years)

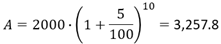

Example:

Let the principal amount be $2,000,this amount is deposited in a bank paying an annual interest rate of 5%.

After 10 years the new principal sum is $3,257.8

It is said that even middle-class wage earners eventually can amass sizable investment accounts, it just takes time and perseverance.

Let’s get deeper!

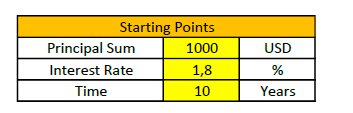

Let’s say we got this:

Which we consider low values, if we gradually increase them we have the following (using the compound interest formula):

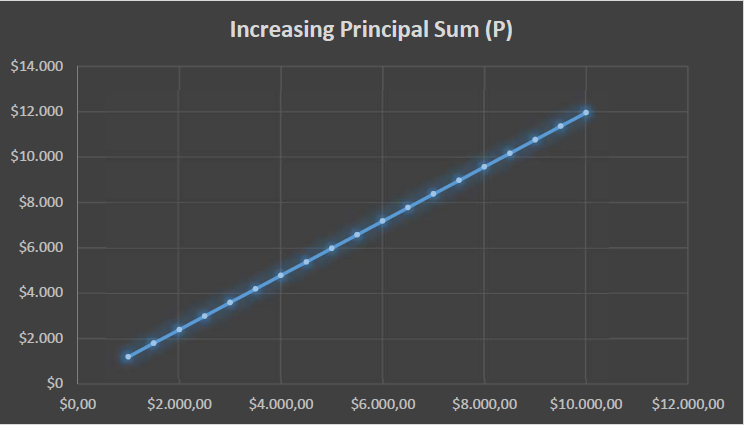

Case A) Increasing Principal Sum

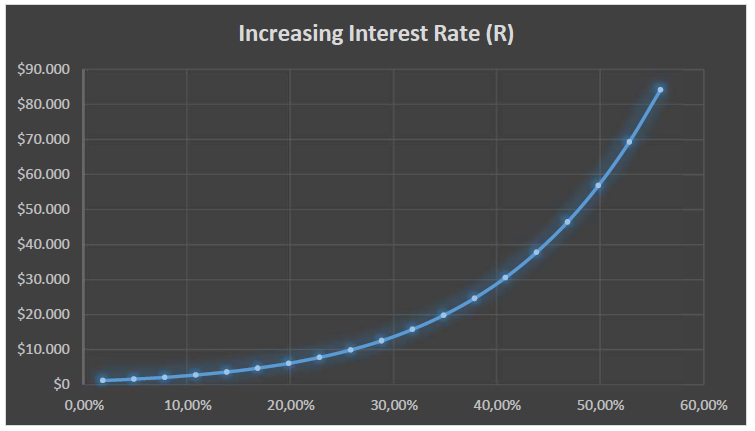

Case B) Increasing Interest Rate

Case C) Increasing Time

In the first table case At, we are increasing the amount which will be compounded, you can see how it’s increasing the final value as we increase the amount.

Second table shows how the final value varies as we increase the interest rate.

Third table shows us that as the time pass the new principal sum does as well.

Analyzing these tables comes a great question to ask: What will bring us better results?

Let’s analyze then which has a better growing rate:

A)Increasing the amount invested

B) Increasing the interest rate:

B) Increasing time

Which one you think that could give you better results?

- The original principal sum

- The interest rate

- The time we will be compounding

The answer is that the original principal sum (Case A) shows a linear growth, whereas the interest rate (Case B) and the time (Case C) influence in an exponential growth.

So you can tell that these two factor are the keys factors for growing wealthy.

Let’s analyze then these two key factors:

Interest rate:

From Andrew Hallam we can tell that the money in U.S. and international stock markets that, from 1990 to 2011, have averaged more than 10 percent annually.

Increasing or decreasing the interest rate is not something we can control, so we can’t do much about it.

The time we will be compounding

This is the key to succeed:That’s something that we can control, and we can take advantage of the nature of it, days by day we can’t stop time we can’t be younger than we are right now. This is one of the best tool we can use for getting richer than yesterday.

The dilemma: Would you choose to have more money to compound and start later or don’t have much money and start compounding sooner?

If you have read this post to this paragraph you can tell which one is: We already clarified that the principal sum have a linear growth and the time have grown in an exponential rate.

So I would rather start earlier than having a good amount of money to invest. This relates to the Noah Principle

Now that we know why it is a pretty good idea frugal living and how frugal living is the best way to become wealthy (We have more to invest, and we can compound earlier as we start saving/investing on time).

Frugal Living Tips

1-Just spend on things that bring you happiness.

2-Learn to say no.

3-Keep track of income and expenses.

4-Choose well where you do the shopping.

5-Make a list specifying what you own and what you really need.

6-Avoid supermarkets traps so that you buy more than what you want.

7-Try to always eat at home, avoid restaurants.

8-Reduce transportation costs: take a walk or bike. You will also be healthier.

9-Take advantage of the sharing, for example, traveling by car with other people will help you save few some cash.

10-Sell or give away your belongings that are not essential for you.

11-Try to do things yourself, don’t hire people to do stuff you can do on your own.

12-Avoid debt.

13-If your salary goes up, don’t make your expenditures go up as well, save money.

14-Make a routine on saving. Save money by consuming less on electricity, water, phone, etc. When doing this you can see how to save more money every day

15-Invest in education -Increase Your Financial Literacy, Subscribe to Topemesh – Read books/articles that help you increase your Financial IQ.

Invest in education NOW, the variable time is pretty important when it comes to money, now you know why, what are you waiting for?

Resources:

(I may earn a small commission at no cost for you for my endorsement, recommendation, testimonial, and/or link to any products or services from this website.)

Millionaire Teacher: The Nine Rules of Wealth You Should Have Learned in School

How to Make Money in Stocks: A Winning System in Good Times and Bad, Fourth Edition