Is It Worth Investing In Cardano

How price appreciation and staking rewards make me financially independent, is Cardano a good investment?, is it worth investing in Cardano?, price prediction.

If you would like a more visual presentation, feel free to check our YouTube video.

What’s Cardano

Cardano claims to be a third-generation cryptocurrency that solves the problems of first-generation cryptocurrency Bitcoin and Second Generation Cryptocurrency Ethereum. The cryptocurrency was founded by Charles Hoskinston in 2017 and uses the token symbol ADA, this name was given in honor to the 19th-century mathematician Ada Lovelace.

This cryptocurrency uses proof of stake consensus mechanism that allows any holder of ADA that decides to delegate their ADA, participate by validating blocks transactions.

Cardano is a platform with a rigorous structure and design that is capable of performing a high volume of financial transactions with a high level of security that is backed by cryptography technology.

Cardano will enable innovative development of smart contracts better than it already was and decentralized applications also known as dApps.

Passive Income From Crypto – Ways To Earn It

When buying cryptocurrency, you are generating another source of income that does not require to be actively working on it to earn revenue. Cryptocurrencies are a good way to earn passive income. The cryptocurrency market has been constantly expanding and because of this, more and more ways to generate passive income by the use cryptocurrencies have come to exist.

Mining: This is one of the main technologies behind some currencies such as Bitcoin, and many other altcoins such as Dogecoin, Monero, and many other. Mining consists in using one’s computing power to validate or secure a network and be rewarded for that. Today, mining is no longer something everyone with a laptop or PC could do, in fact, it requires extremely powerful computers, and some degree of technical knowledge.

Decentralized finance or most commonly known as “DeFi” is a new financial system that operates independently and does not depend on centralized financial intermediaries. With DeFi users have the ability to transfer,invest, and also trade cryptocurrencies and digital assets through automated smart contracts that do not require the use of a large number of employees, as we know in traditional finance.

Staking is another technology used by some of the major cryptocurrencies to validate transactions on their network. Cardano uses The Ouroboros Proof of Stake (PoS) to validate transactions, users who store crypto are rewarded for validating transactions, without the need for powerful equipment for mining, with this, any user who has any of these cryptocurrencies can stake in a staking pool and be rewarded.

Staking Rewards

Staking On Binance And Other Wallets

There is some debate of whether you should stake your coins in Binance or not:

When asking this on reddit you will find that the vast majority of redditors are on the side of not staking on exchanges like Binance, claiming that this doesn’t help decentralization and that you don’t own your private keys, you may have head “Not your coins, not your keys” and suggest moving your ADA to a wallet like Daedalus or Yoroi, because it’s easy and safer. Depending on the pool you choose you might have some very high return epochs and some low, but over the year it averages out to be around 5% – 6.5%.

My Investing Strategy

How do we know if it is worth investing in Cardano, check out our investing strategy!

This is how we’re able to make passive income with just one year of active investing.By just investing 200 USD Monthly, for a year in Cardano and staking all of it, can get us far better than the majority in the crypto space.

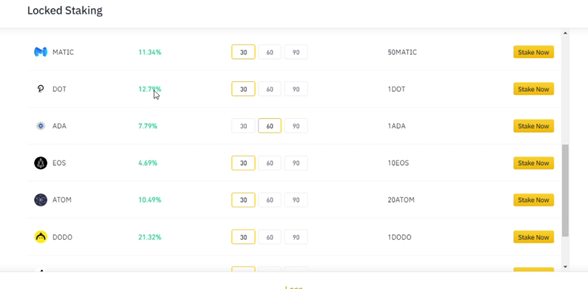

Binance Maximum APY is currently of 7.79%, in locked staking that means that you’re not able to trade you’re ADA coins in a period of 60 days.If you choose to stake for fewer days, you will regularly get a lower APY, for example at the moment, 30 Day locked staking give you a 5.09% APY. Binance often encourage users to stake by providing a very high APY for a short period of time and a short amount of ADA.

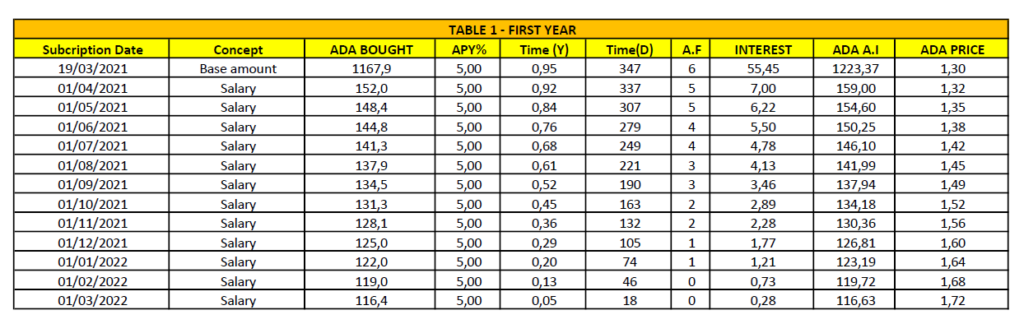

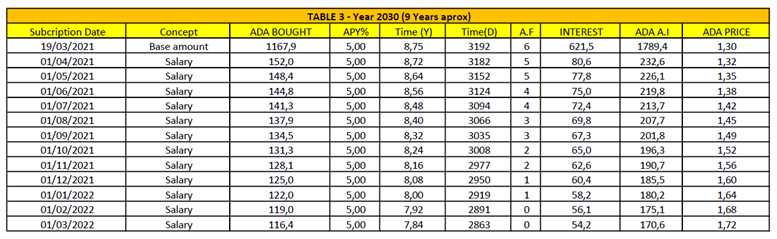

In this case study we’ll start in 19/03/2021 with 1168 ADA and start investing 200 USD worth of ADA the following 12 month until 01/03/2022.We will also you show what would be the case if we didn’t have that 1168 ADA initially and start from 0 ADA, investing 200 USD a month.After reading the case study below, you will know the answer to: Is It Worth Investing In Cardano.

Binance Staking

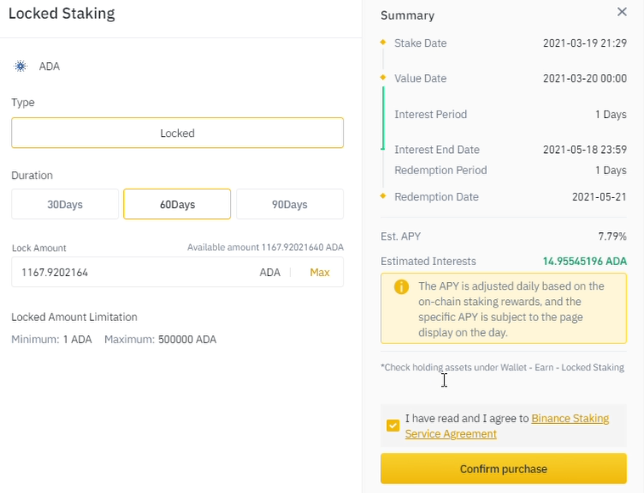

Stake Date: This is the day on which we began to stake our coins in Binance.

Redemption Date: This is the date on which we can freely use our ADA that had been locked. The time span here is 63 days from the Stake Date. The reason why we unlock our ADA after 63 month is due to the fact that we chose 60 days as our period to lock our coins and Binance added an additional 3 days. We would have chosen the 90 days option if it had not been sold out, we would have had a much greater APY.

APY: This is the annual interest rate. In this case the APY is 7.79%.

The estimated interest refers to the amount of ADA earned due to interest, by staking our coins. As you can see staking our 1168 Ada coins with a 7.79% APY for 60 days yields a 7.5 ADA/monthly passively.

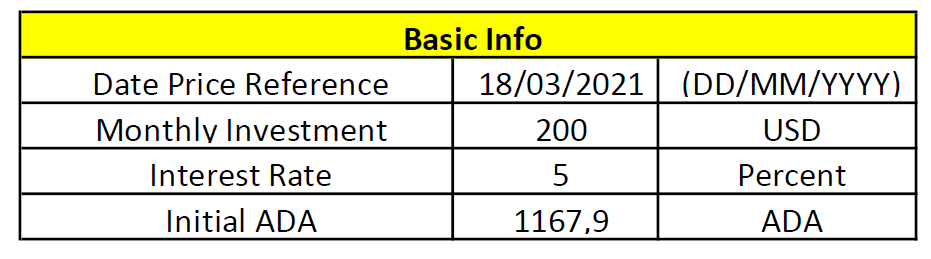

Date Price Reference: This is the date on which we decided to start the price growth model.

Monthly Investment: This is how much ADA we are buying each month; how much we are spending each month buying ADA in USD.

Interest Rate: This is the interest rate we are earning for lending or staking our ADA. We took a conservative value of 5 percent.

Initial Ada: This is the amount of ADA we currently have.

Price Growth Model

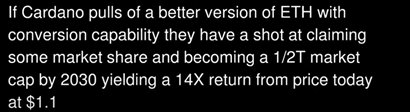

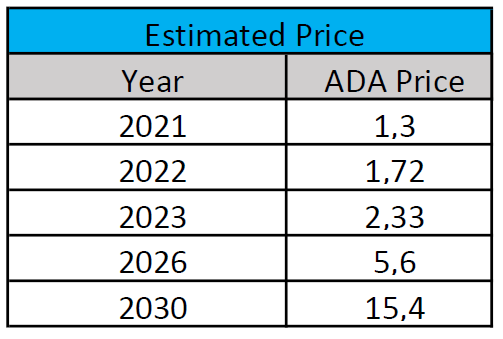

This is very speculative, Cardano could drop to 0 or go order of magnitude higher of it’s current price. We don’t know for sure, and yes, Cardano do have a lot of potential but it’s market value depends in a lot of factors we and probably anyone in the world could not know beforehand. What we did is that we took a conservative value for the price of ADA in 2030. Just to get a overview of what our earnings we’ll be if the price of 1 ADA is around that number.

We just use estimated price made by: InvestAnswers, in his video “ETH vs ADA ie Ethereum vs Cardano Ultimate Guide including Price Predictions”

So, in 2030, ADA could be worth 14x $1.1=15.4 USD

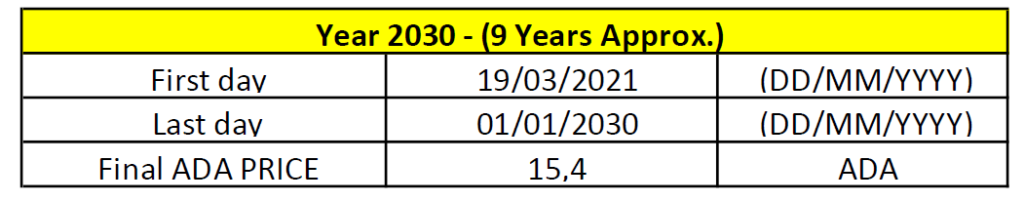

Earnings Over Time By Staking

So if we assumed the price of ADA is growing exponentially from the Date Price Reference (18/03/2021) to (18/03/2030) then, we have the following:

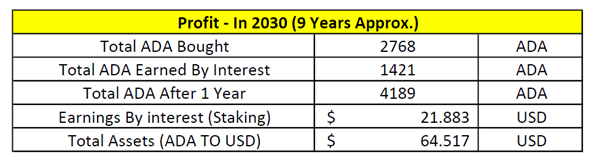

How putting aside 200 monthly to buy ADA is enough for wealth creation.

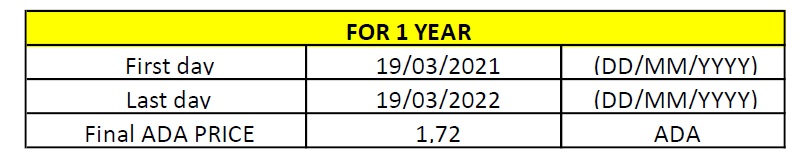

Analysis 1 Year

After 1 year of holding ADA we have:

First Day: This is the date in which we bought our first ADA, and thus we start our analysis.

Last Day: This is the time on which our analysis stops. The time span between the first day and the last day is one year.

Final ADA Price: Is the estimated price of 1 ADA at the end of the year.

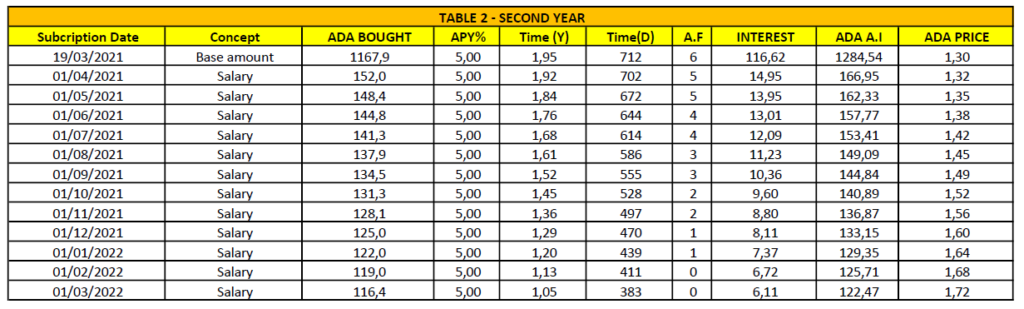

The Subcription Date is the same as the Stake Day or the day in which we begin to stake our ADA.

Concept: We have a base amount or an amount prior to the monthly investment on which we will be make our analysis.

ADA Bought: Is the amount of ADA to be purchased each month, this is =Monthly (USD) Spent/ADA price. In this case we use 200 USD Monthly

APY%: The assumed interest rate, that is applied annually. This APY% in a real case scenario will vary on multiple technical factors such as Distribution Rate, Total Blocks Per Epoch, Stake Ratio, Saturation Limit. As stated by SkyLight Pool (SKY). Read More.

Time(Y): Time in years (Y) from the Subscription Date to the Last Date.

Time(D): Time in days (D) from the Subscription Date to the Last Date.

A.F: The A Factor is something we used to make a more precise analysis of the time that we’ll be gaining interest by staking, is something as a correction factor.

Interest: This is the amount of ADA we will be earning from staking alone.

ADA A.I or ADA After interest: The amount of ADA we’ll have after interest that is our ADA that we are delegating to the pool plus the rewards earned. ADA bought + Interest.

Market Valuation of ADA (Price): An estimated number that represent the growth of ADA price month after month. This gives us an estimate of the amount of ADA we will be getting after buying each month.

(Note that in a real-world scenario the ADA price could drop significantly or could go up do to external factor such as new releases, mayor investor, hype from social media etc…)

Now to the point: Is It Worth Investing In Cardano? Let’s see our profits

Profits Year 1, Year 2, Year 3, Year 9

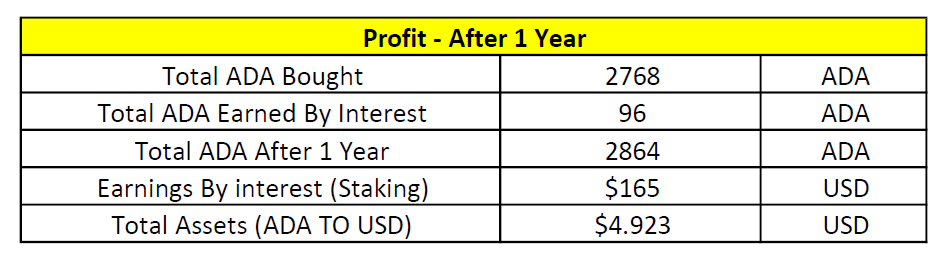

Profit After 1 Year:

After 1 year later, we have a total of 2768 ADA bought. The total amount of ADA earned purely from staking is 96 ADA. (We earned 96 ADA passively). After one year, than we would have a total of 2,864 ADA.

If the price of ADA is as estimated around 1.72 USD. Then Our 96 ADA would be worth 165 USD and our total amount of ADA would be worth almost 5k USD.

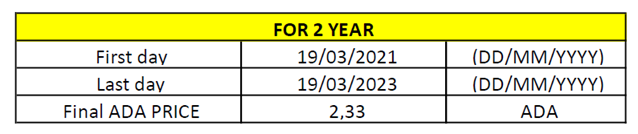

Analysis (2 Years)

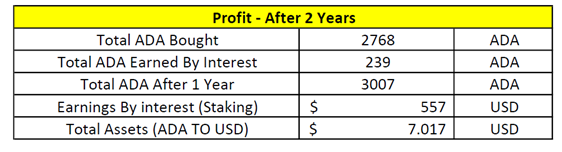

Profit After 2 Years

The same could be done and estimate our profit after two years of staking without withdrawal.

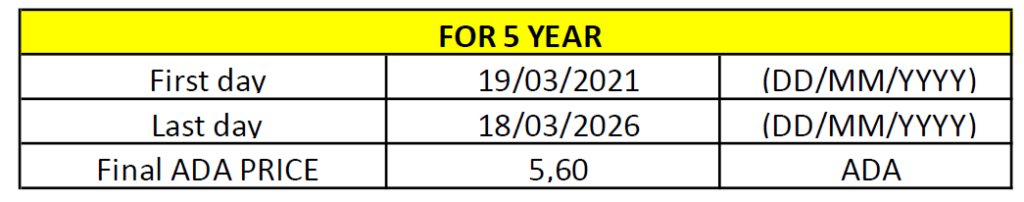

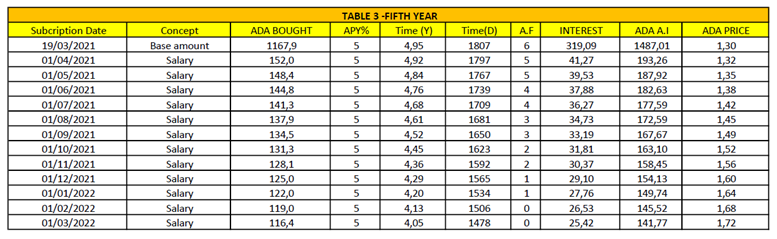

Analysis (5 Years)

Profit After 5 Years

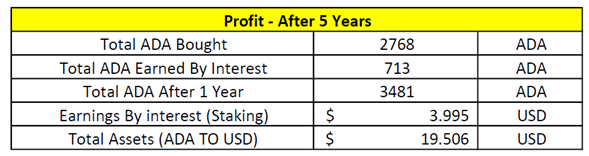

Analysis (Year 2030)

Profit – Year 2030

As you can see in this example just by investing 200 USD/Mo for a year, and just having around 1200 ADA beforehand, can yield incredible results.

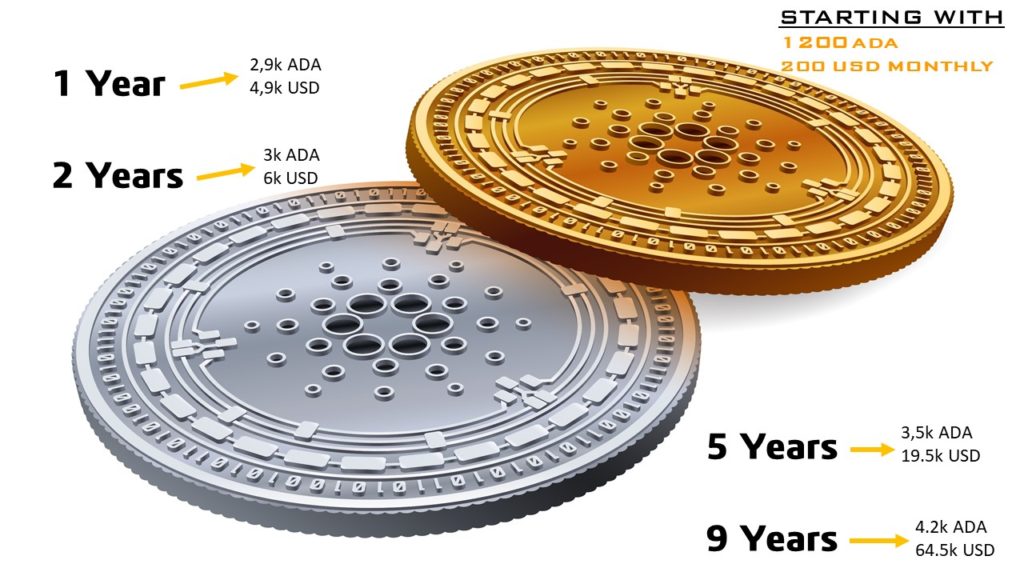

Let us say you had 0 ADA already invested, and you’re considering putting aside 200 USD monthly, you could expect the following.

Is It Worth Investing In Cardano? We are very bullish on Cardano, and as you can see by just investing 200 USD worth of ADA a month for just one year, you can have extraordinary results. Make sure to put aside a set amount of USD by being frugal (Check out our article on How Frugal Living Is The Best Way To Become Wealthy) and also do your best to increase your income, the synergy of investing on time, while being frugal and expanding your source of income is right path to become wealthy

Assumptions

- We assumed that ADA Price in year 2030 will be around 15 USD.

- The market valuation of ADA growths exponentially

- We used Dollar-Cost Averaging (DCA) investment strategy

- All earnings are automatically invested.

- The average interest rate earned by staking annually is around 5%

Note: The amount of dollars represented in this calculation is in today’s purchasing power (March of 2021).

We have done a tremendous amount of work, analysing, creating and producing this for you.

You can support us by subscribing to our youtube channel, following us on instagram and facebook.

Support us on Patreon